Central Banks Fuelling Climate Crisis, Including RBI: New Report

Between 2016 and 2020, central banks have failed to prevent financial flows to fossil fuels

Central banks can play a key role in mobilizing capital away from fossil fuels. Many of the world’s central banks have signed up to the Network for Greening the Financial System, which recognises the threat that climate change poses to financial stability, and recommends taking action to reduce support for fossil fuel finance — but to what extent are they living up to their words?

According to a newly released report Twelve of the largest central banks around the globe continue to support climate chaos-causing fossil fuels through policy and direct finance,The new analysis, conducted by Oil Challenge International and endorsed by 20 other civil society organizations, focuses mostly on what central banks have done to reduce the scale at which finance flows to fossil fuel production. It finds most have done little to nothing.

Between 2016 and 2020, central banks have failed to prevent financial flows to fossil fuels on the order of USD 3.8 trillion from commercial banks.

Central banks have ignored proposals to use reserves requirements or prudential regulation to this end and have resisted calls to adjust their mandates in light of the climate crisis

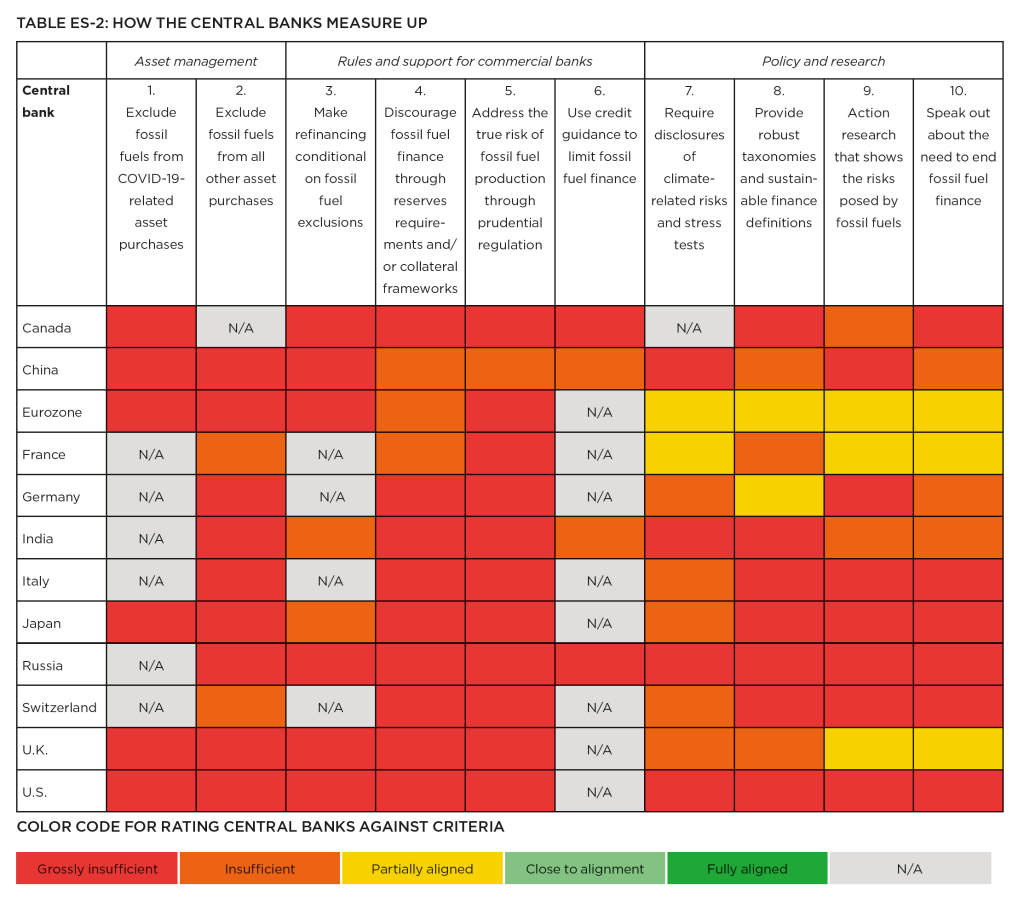

The report identifies 10 criteria for assessing central banks against the Paris Agreement’s goal, and applies them to assess 12 major central banks. The central banks of these country desks are of particular concern: Canada, China, India, Japan, UK.

Tracey Lewis of 350.org said:“This report is yet another reminder that central banks are the referees of our economy. When banks do bad — like financing fossil fuel companies hell-bent on planetary destruction — the ref is supposed to blow the whistle. Ahead of COP26 in November, the Federal Reserve must use their legal authority to manage climate risk and steer us off fossil fuels fast.”

Many central bankers have made public statements saying that they will push the most authoritative financial institutions to be greener, but this report found that none of them comes close to alignment with the Paris Agreement. The central banks have a plethora of powers at their disposal to catalyze the rapid shift from fossil fuel, but they aren’t using them.

None had taken significant steps on fossil fuel financing, despite all being members of the Network for Greening the Financial System, which recognises the risks to the financial system of climate change and of fossil fuel finance.

You can see how the central bank is measured and the color ratings against the criteria in the chart below. The assessment takes into account the difference in mandate between central banks (for example, not all are the prudential supervisors of commercial banks).

Paul Schreiber, of Reclaim Finance said: “Despite recognizing that climate change is fully relevant to their mandate and being bound by the Paris Agreement, central banks continue to help fossil fuel companies to benefit from cheap and ample funding. While the ECB and Bank of England are contemplating how to align part of their activities with the Paris Agreement, this report underlines that they will fail unless they adopt strong fossil fuel policies, starting with a clear cut of their support to companies that develop new fossil fuel projects. Failure to do so would come down to greenwashing.”

The only concrete positive measures taken that the report identifies are publishing useful research, issuing robust taxonomies to define assets as polluting or clean, or making statements about the importance of addressing climate change. Modest steps in this direction have been taken by the European Central Bank, the Banque de France, and the Bank of England; while the Reserve Bank of India and the People’s Bank of China also took some smaller steps.

Views expressed here are those of Dr. Seema Javed, a known Environmentalist, Journalist and Communications Expert