JSW Energy Delivers Strong Performance In FY24, Achieving Highest-Ever EBITDA Of ₹5,837 Crore

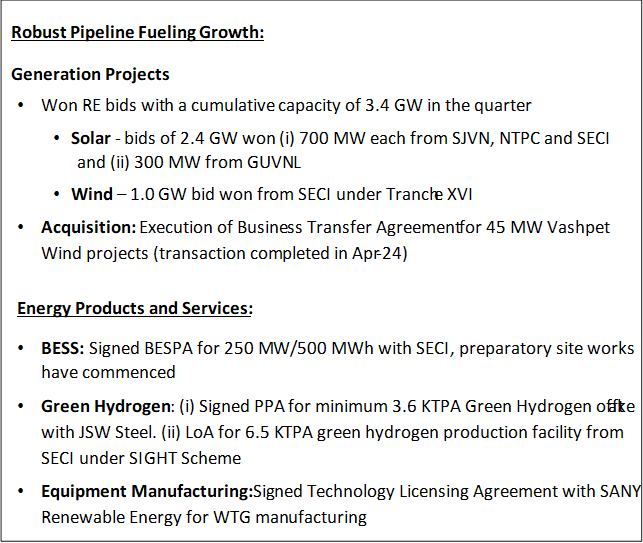

The company made significant strides towards the outlined target of 20 GW by FY2030 by locking in additional RE (Renewable Energy) projects with a cumulative capacity of 3.4 GW

JSW Energy Limited today reported its results for the quarter (“Q4 FY24” or the “Quarter”) and the financial year (“FY24” or the “Year”) ended March 31, 2024.

FY2024 – Delivering Sustainable Growth

JSW Energy delivered a strong performance in FY24, achieving the highest ever EBITDA of ₹5,837 Crore. The company made significant strides towards the outlined target of 20 GW by FY2030 by locking-in additional RE (Renewable Energy) projects with a cumulative capacity of 3.4 GW.

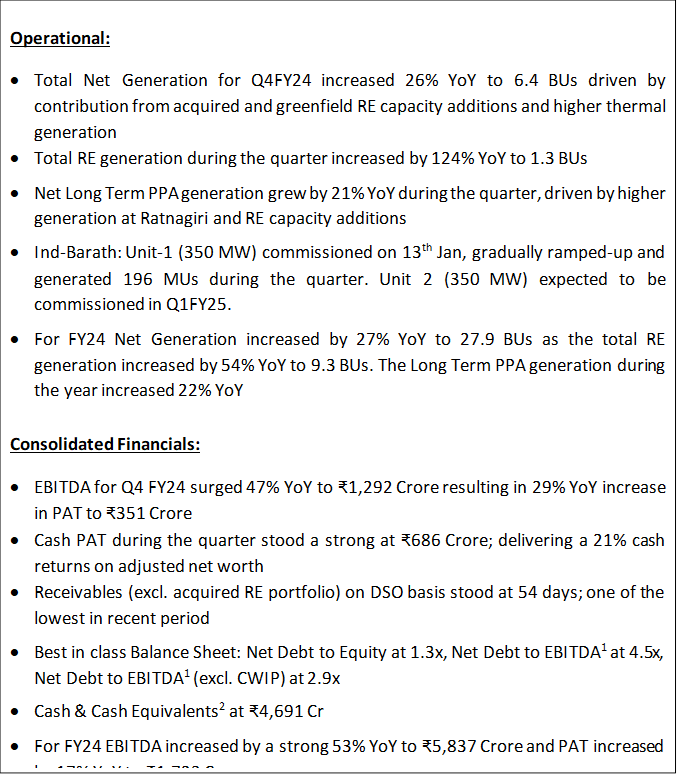

Following are some of the key achievements and recent developments:

§ Strong Financial Performance: EBITDA for the year increased by a robust 53% YoY to ₹5,837 Crore resulting in PAT growth of 17% YoY to ₹1,723 Crore.

§ Successfully Raised Growth Capital: Raised ₹5,000 Crore of equity growth capital through Qualified Institutional Placement. The issue was subscribed 3.2 times witnessing an overwhelming response from marquee global and domestic investors.

§ Strengthens Project Pipeline: Secured additional RE projects with cumulative capacity of 3.4 GW during the year, exhibiting a notable 36% surge in the locked-in capacity to 13.2 GW.

§ Capacity Growth: Added greenfield capacity of 681 MW during the year. Achieved a significant milestone by commissioning Ind-Barath Unit 1 (350 MW), marking it one of the fastest revival of a stalled thermal power plant in India.

§ Forayed into Energy Products and Services: Signed BESPA for India’s largest BESS project and the preparatory site works have started.

§ ESG Stewardship: Achieved ‘Leadership Band (A-)’ in CDP Climate Change for third consecutive year – Highest rating in the power sector in India.

Summary of Operational and Financial Performance Q4FY24 and FY24 (Consolidated)

During the quarter, Net Generation stood at 6,397 MUs, up 26% YoY driven by higher contribution from acquired and greenfield RE capacity additions and higher thermal generation.

Total generation under Long Term PPA in Q4 FY24 increased by 21% YoY driven by higher generation at Ratnagiri and RE capacity additions. Short Term sales surged during the quarter with strong underlying power demand growth in the country.

Net Generation in FY24 increased 27% YoY to 27.9 BUs driven by contribution from RE capacity addition and strong thermal performance. RE Generation increased 54% YoY to 9.3 BUs in FY24 while Long Term generation increased 22% YoY representing 88% of the Total Net Generation.

PLFs achieved during Q4 FY24 at various locations/plants are as follows:

· Vijayanagar: The plant operated at an average PLF of 59% (59%1) in the quarter vis-a-vis 58% (59%1) in Q4 FY23.

· Ratnagiri: The plant operated at an average PLF of 87% (100%1) in the quarter vis-a-vis 74% (98%1) in Q4 FY23 as both ST and LT volumes grew.

· Barmer: The plant operated at an average PLF of 83% (87%1) in the quarter vis-a-vis 82% (87%1) in Q4 FY23.

· Ind-Barath: Unit-1 which was commissioned on 13th January operated at an average PLF of 63% (70%1) in the quarter.

· Hydro: The plants operated at an average long term PLF of 13% for the quarter vis-a-vis 14% YoY.

· Acquired RE Portfolio: Solar (422 MW) achieved CUF of 22% while Wind (1,331 MW) achieved CUF of 15% in the quarter.

· Solar (Organic): The solar plants achieved an average CUF of 29% in Q4 FY24, same as Q4 FY23.

· Wind (Organic): The wind plants achieved an average CUF of 25% in Q4 FY24 vis-a-vis 30% in Q4 FY23.

Consolidated Financial Performance Review and Analysis:

During the quarter, Total Revenue increased by 3% YoY to ₹2,879 Crore from ₹2,806 Crore in Q4 FY23. EBITDA in the quarter grew by a strong 47% YoY to ₹1,292 Crore, driven by incremental contribution from renewable portfolio and strong performance by thermal assets.

Finance costs during the quarter increased to ₹533 Crore vis-à-vis ₹233 Crore in Q4 FY23 due to additional borrowings (for ongoing growth capex and including the acquired RE portfolio) and increase in weighted average cost of debt to 8.64% as of Q4 FY24 (from 8.36% in Q4 FY23) with the rising interest rates cycle.

Profit after Tax increased by a robust 29% YoY to ₹351 Crore in the quarter while the Cash PAT during the quarter stood at ₹686 Crore.

For FY24 Total Revenue increased 10% YoY to ₹11,941 Crore from ₹10,867 Crore in FY23. EBITDA for the year grew by 53% YoY to ₹5,837 Crore driven by RE capacity additions and strong thermal performance. Profit after Tax increased by 17% YoY to ₹1,723 Crore as compared to ₹1,478 Crore in FY23.

The Board recommended a dividend of ₹2.0 per share subject to approval of the shareholders.

The Consolidated Net Worth and Net Debt as on Mar 31, 2024 were ₹20,832 Crore and ₹26,636 Crore respectively, resulting in Net Debt to Equity ratio of 1.3x. Net Debt to EBITDA1 stood at 4.5x, with Net Debt to EBITDA1 (excl. CWIP) at a healthy 2.9x. Receivables in DSO terms (excl. Acquired RE) are at a healthy level of 54 days.

Liquidity continues to be strong with Cash balances2 at ₹4,691 Crores as of Mar 31, 2024. The Company has one of the strongest balance sheets in the sector which gives it the headroom to pursue value accretive growth opportunities.

Business Environment[1]:

· India’s power demand increased by 7.4% YoY in Q4 FY24, driven by heating requirements in the early part of the quarter followed by cooling requirements in latter part of the quarter. For FY24 power demand increased by 7.5% YoY.

· Further, All-India peak power demand touched a high of 243 GW in the month of September 2023, while the peak demand in Q4FY24 stands at 223 GW.

· In line with demand, overall power generation increased by 7.3% YoY and 7.1% YoY for Q4FY24 and FY24 respectively. In FY24 renewable power generation increased 11% YoY driven by both higher solar and wind generation (up by 14% YoY and 16% YoY respectively). Thermal generation increased by 10% YoY while Hydro generation was down 17% YoY.

· On the supply side, installed capacity stood at 442 GW as on March 2024. In Q4 FY24, net installed capacity increased by 13.7 GW, due to addition in 9.8 GW of renewable capacity.

Outlook:

· As per the IMF’s latest “World Economic Outlook” (April 2024), global economic growth is expected to be stable but slow, with global GDP growth of 3.2% for CY2024 and CY2025. For India, the IMF estimates GDP growth of 6.8% in CY2024 and 6.5% in CY2025.

· As per the Reserve Bank of India (RBI), India’s GDP saw a growth of 8.4% YoY in Q3 FY24, the fastest pace in six quarters, led by a strong manufacturing and construction activity. Estimates for FY25 real GDP growth is projected to be at 7%. Repo rate remains unchanged at 6.50%.

· India’s latest macro-economic data reflect a resilient economy in the midst of a slowing global economic landscape. Both manufacturing (Mar-24: 59.1) and services (Mar-24: 60.3) PMI prints remain strong. Gross GST collection trend continues to be robust at 1.78 trillion in Mar-24, up 11% YoY and 12% for FY24.

· In March, CPI eased to a 10-month low of 4.85% and remains within the RBI’s tolerance mark.

· Over the medium term, the power sector outlook is healthy, as rapid urbanization, government led capex and a strong investment cycle are expected to boost overall power demand.

· However, with base load capacity increase (including RTC with storage) lagging the demand growth, supply increase is expected to lag demand growth over the medium term, boding for tight demand – supply conditions.