Oxford University Report: Cost Of Finance For Coal Power Up 56%

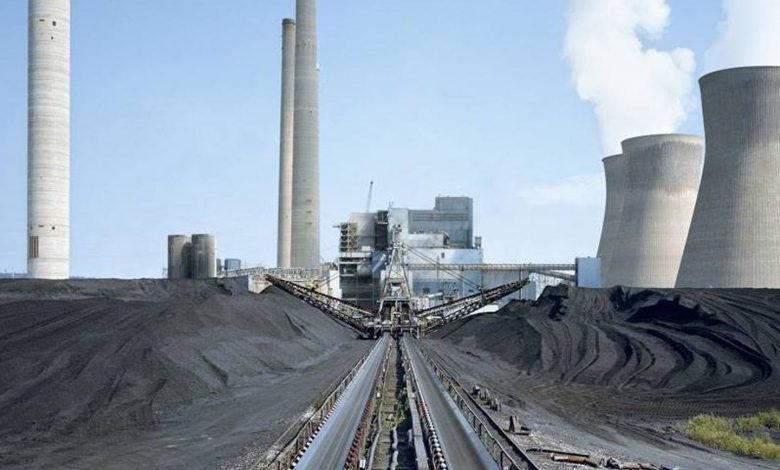

A new study by Oxford University’s Sustainable Finance Program shows how the cost of finance for coal mines and coal power plants have increased by 54% and 38% respectively over the last decade, comparing 2007-2010 and 2017-2020.

Comparing 2000-2010 and 2011-2020, loan spreads for coal power have risen in North America, India and Southeast Asia nations by 47%, 63% and 63% respectively. Interestingly, the sum of loan volume has grown sharply in Southeast Asia and India, while it has decreased from $14 billion to $8 billion in North America.

At the same time – the cost of finance for solar and wind have declined considerably. When comparing 2007-10 with 2017-20 renewables have seen their loan spreads fall by an average of 12% for onshore wind and 24% for offshore wind. This has accelerated since 2015 as renewables deployment has increased, with solar PV, onshore wind, and offshore wind financing costs falling by 20%, 15% and 33% (comparing 2010-14 with 2015-20).

New Oxford University research tracking how the financing costs for energy projects, measured through loan spreads, have changed over the past 20 years finds that financial institutions are viewing renewables as less risky and coal as more so. Oil and gas financing costs have exhibited significantly less change.

When comparing 2007-10 with 2017-20 renewables have seen their loan spreads fall by an average of 12% for onshore wind and 24% for offshore wind. This has accelerated since 2015 as renewables deployment has increased, with solar PV, onshore wind, and offshore wind financing costs falling by 20%, 15% and 33% (comparing 2010-14 with 2015-20). We also observe regional differences. Over this time period, there was a 39% reduction in financing costs for offshore wind in Europe; 41%, 14%, and 11% reductions for onshore wind in Australia, North America, and Europe; and 32% and 27% reductions for solar PV in North America and Europe.

In contrast to renewables, comparing 2007-10 with 2017-20, coal power stations and coal mines have seen their loan spreads increase sharply, at 38% and 54% respectively. This trend holds when comparing 2000-10 with 2011-20, with loan spreads rising 56% and 65% respectively. We find that the financing costs for coal mines

increased the most in developed countries, with loan spreads increasing by 80% in North America, 134% in Europe, and 71% in Australia when comparing 2000-10 with 2011-20.

Key findings

Loan spreads for coal mines and coal power stations have increased dramatically, rising 54% and 38% over the last decade, comparing 2007-2010 and 2017-2020. This clear increase in loan spreads supports the findings of Fattouh et al. (2019), who show that investors perceive coal as significantly higher risk than other energy

projects.

Comparing 2000-2010 and 2011-2020, the average loan spread for coal mining has grown faster in developed markets such as Europe, North America and Australia, at 134%, 80% and 71% respectively, relative to emerging markets such as Latin America, China, and Southeast Asia, at 56%, 32% and 12% respectively.

Over this period, loan spreads for coal power have risen in North America, India and Southeast Asia nations by 47%, 63% and 63% respectively. The sum of loan volume has grown sharply in Southeast Asia and India, while it has decreased from $14 billion to $8 billion in North America.

However, in oil and gas, changes to financing costs are much more mixed and have in many cases decelerated over the last decade. For example, while loan spreads for gas-fired power stations rose by 68% from 2000-10 to 2011-20, an increase of just 7% occurred over the past decade whereas coal power rose 38% (comparing 2007-10 with 2017-20). Across regions, there have been large differences: gas-fired power saw a 23% reduction in loan spreads in ASEAN but a 16% increase in North America when comparing 2000-10 with 2011-20. But over the past decade, loan spreads for gas-fired power have decreased by 28% in North America (comparing 2007-10 with 2017-20).

In terms of oil and gas production, while financing costs worsened if you compare 2000-10 with 2011-20, over the past decade, loan spreads have been largely stable, rising by only 3% for oil and gas production. In fact, loan spreads for certain sub-sectors fell over this period, such as -41% for offshore oil. This suggests that

financial constraints on oil and gas have not materialised in the same manner as coal.

Dr Ben Caldecott, co-author and Director of the Oxford Sustainable Finance Programme and the Lombard Odier Associate Professor of Sustainable Finance at the University of Oxford said, “This is good news for the cost of renewables, as financing costs are a key determinant of overall costs. Falling loan spreads for renewables mean

these projects will become even cheaper for ratepayers and taxpayers, which is a good thing for rapidly decarbonising the energy sector.”

Dr Xiaoyan Zhou, Lead for Sustainable Investment Performance at the Oxford Sustainable Finance Programme and the lead author said, “If these observed trends continue and we see the cost of capital for oil and gas go the way of coal, this could have very significant implications for the economics of oil and gas projects around the

world. This could result in stranded assets and introduce substantial re-financing risks.”

Dr.Seema Javed is an Environmentalist, Independent Journalist & Strategic Communicator for Climate Change